Digital Payments: A Promising Farewell to Cash

10 October 2025

Overview

Smartphones are increasingly replacing traditional wallets, and digital payments are rapidly supplanting cash. This shift is a major growth driver for the payments sector and presents attractive opportunities for investors focused on digitalisation and the digital economy.

Bertrand Born & Luca Menozzi, Portfolio Managers

Why Digital Payments Matter

- Regulatory Momentum: The U.S. Senate’s recent approval of the Genius Act could bring stable‑coins under clear regulation, paving the way for broader adoption across the payments ecosystem.

- Speed & Cost Efficiency: Stable‑coins promise near‑instant, low‑cost transactions that can bypass many traditional financial intermediaries.

- Innovation Pipeline: Software, digital technology, and payment infrastructures are converging to create new value‑added services and business models.

Stablecoins – The Future of Digital Payments?

Decentralised finance (DeFi) eliminates traditional intermediaries by using blockchain‑based applications. Stablecoins—cryptocurrencies pegged to a reserve asset such as a fiat currency, gold, or a basket of assets—aim to combine the stability of conventional money with the efficiency of crypto.

Key examples:

- Tether (USDT)

- USD Coin (USDC)

- DAI

Potential benefits

- Faster, cheaper cross‑border payments.

- Reduced volatility compared with other cryptocurrencies.

Challenges

- Regulatory uncertainty.

- Technical risks (e.g., loss of peg, liquidity shortages).

Digital Payments as a Showcase of Digitalisation

The payment ecosystem illustrates the convergence of finance, technology, and fintech. It highlights how digital services can drive:

- Financial inclusion – Reaching unbanked populations via mobile devices.

- Sustainability – Enabling efficient, low‑carbon transactions across borders.

Fundamental Drivers in the Payment Ecosystem

| Driver | Description |

|---|---|

| Decline in cash usage | Global cash usage is falling; contactless payments accelerate the trend. Barclays’ Global Cash Model (2024) projects cash to represent ~20 % of payments by 2030. |

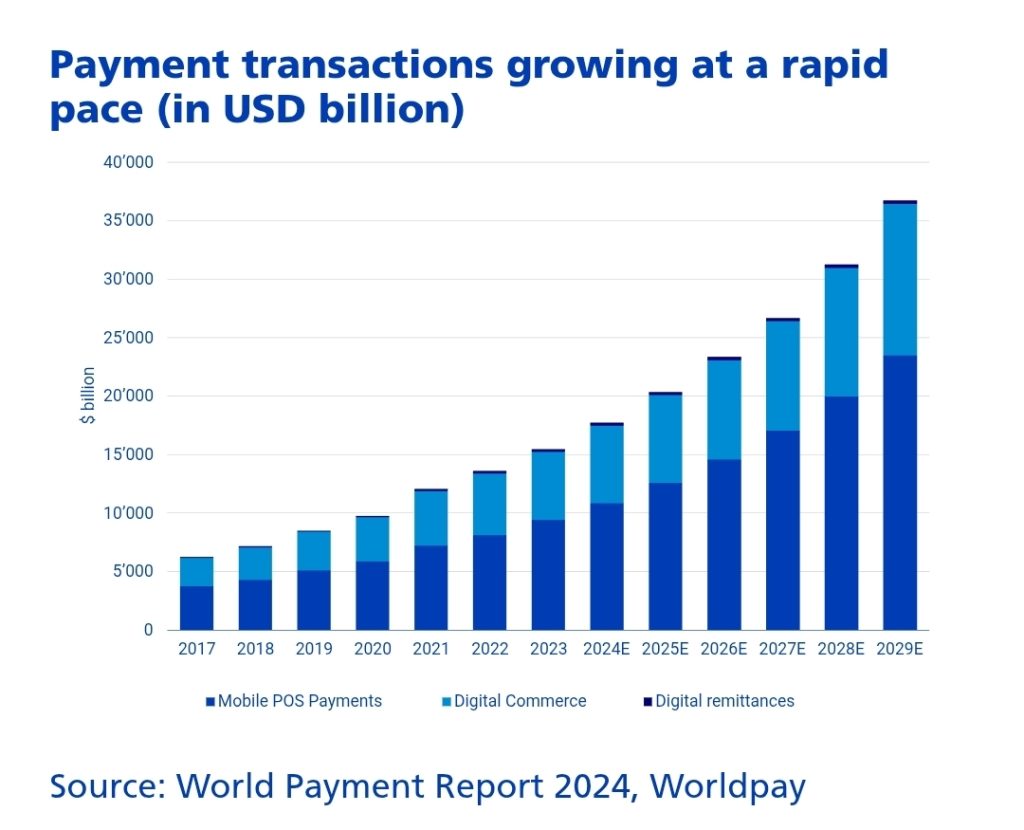

| Growth in transaction volume | Worldpay forecasts payment volumes exceeding USD 36 trillion by 2029, driven by POS, e‑commerce, and digital money transfers. |

| Expansion of ancillary services | Integration of mobile/card payments, digital wallets, international transfers, cybersecurity, fraud prevention, analytics, and AML solutions. |

Who Benefits?

A typical credit‑card transaction involves several players:

- Consumers

- Merchants

- Acquirers (provide terminals)

- Card Networks (Visa, Mastercard, etc.)

- Issuers (banks or neobanks)

Merchants pay a Merchant Discount Rate (MDR), which is split among acquirers, networks, and issuers (issuers receive up to ~70 % as an interchange fee).

Companies Positioned for Growth

- Card Networks: Visa, Mastercard, American Express – processing > USD 20 trillion annually (≈ 20 % of global GDP). They are expanding into cybersecurity, data services, and consulting.

- Acquirers: Adyen, Fiserv – offering unified, multi‑channel payment solutions for merchants.

- Fintech & Payment Apps: PayPal, Apple Pay, Klarna – adding consumer‑facing experiences.

- Stablecoin Platforms: Tether, Circle (USDC) – targeting remittances and corporate payments.

Digital Payments as a Driver for Digital Empowerment

Beyond profit, digital payments foster:

- Financial Inclusion: Mobile‑based payments reach underserved communities.

- Operational Efficiency: Multi‑currency, cross‑border capabilities help SMEs scale globally.

- Sustainable Growth: Digital infrastructure reduces reliance on physical cash logistics.

Investment Themes

Investors can capture exposure through thematic funds focused on the digital economy, such as:

- Equity Fund Sustainable Digital Economy

- Equity Fund Sustainable Water

- Equity Fund Sustainable Climate

- Equity Fund Sustainable Healthy Longevity

- Equity Fund Sustainable Circular Economy

(All funds are UCITS compliant, managed under Luxembourg law, and distributed in Switzerland only. See the Swisscanto prospectus for detailed terms and risk disclosures.)

Disclaimer

This material is for informational and advertising purposes only, intended for distribution in Switzerland. It does not constitute a solicitation or offer to purchase securities. Investment decisions should be based on the official legal documents (prospectus, KID, etc.) and made in consultation with a qualified advisor. Past performance is not indicative of future results. The products described are unavailable to U.S. persons under applicable regulations.

Prepared by a member of our Social Networks